Before you decide to take your business fully digital, you need to assess your current situation. From this, you will have a better understanding of where your business is, how you can get to where you want it to be, and most importantly, your digital readiness in the fast-moving business landscape.

EY, a global leader in consulting and advisory services, distinguished 4 key elements you should assess: corporate strategy, customer strategy, enabling capabilities and a digital roadmap. To grow from a digitally stunted strategy to digitally mature, these four parts need to be aligned and optimized.

Throughout this post, we’ll help define key components that you need to take into consideration in order to understand your digital readiness.

But before you can begin your assessment, you need to know what each category is:

Corporate Strategy

Corporate strategy is your businesses compass, as it outlines the scope and direction of the entire corporation. This strategy explains how each business function should work together, to not only achieve strategic goals but also to create a competitive advantage. In fact, some would argue corporate strategy is the leading driver of a successful digital transformation, even surpassing technology.

Vision & Mission Statement

One of the biggest separations between digital leaders and, well, losers, is a clear digital culture. To ensure a smooth and positive digital transition, the entire company must be onboard and supportive. The vision and mission statement communicates and outlines the central purpose of the organization and its long-term objective. It sets a tone for employees to follow, and unifies the employees with the same sense of purpose, having everyone work towards a common goal.

Digital Ambition

A full digital transformation requires full dedication and determination. Everyone must be ready to give their all— you get what you give! All employees must be encouraged to take risks, collaborate and innovate. Over 80% of digitally mature companies agree that their workplace emphasizes collaboration, compared with only 34% of digital newbie companies. Moreover, one of the biggest challenges in executing digital readiness strategy is creating a culture of innovation. You shouldn’t limit your employees, motivate them to think outside the box!

Financial Objectives

The most common reason digital transformations fail is due to a disconnect between ambition and level of investment. Outline your financial objectives, for short and long term. Get a clear picture of what resources you currently have, and create a budget. From this, you can allocate your resources to the most urgent matters, and set a realistic financial plan. Moreover, you can also create certain benchmarks to gauge how well your money is being spent (and whether your investments are paying off). All business functions depend on sound financial planning. By formalizing and coordinating your different business functions, you can unify them towards the big picture. And by anticipating financial requirements, you can better prepare for future expenditures.

Customer Strategy

A customer strategy focuses and emphasizes the importance of the customer service. This includes CRM, customer satisfaction, customer engagement, customer loyalty, and overall customer experience. With a customer-focused strategy, there is a deep understanding of customer needs, behaviours, and values.

Segmentation & Personas

To optimize your efforts, you should have a clear understanding of who your target base is. Through this, you can better personalize your entire customer strategy, provide customized digital features, and targeted marketing plans. You can develop a multi-channel view of your customers’ persona, and effectively communicate on all touch points. Customers will build stronger relationships, deeper loyalty, and can even become brand advocates. This will increase your overall efficiency, conversion rates, all while decreasing risks and costs!

Customer Journey & Experience

By identifying your intended customer journey and experience, you can better dissect where you currently stand, and how to reach your end goal. You can determine the needed milestones, and delegate required responsibilities. Customer experience has become increasingly important, and creating a positive customer journey through all touch points is crucial your business success.

Research & Insight

In order to base these understandings off facts, you need to do your homework. Basing any of these elements off assumptions can greatly increase your costs and risks. Additionally, you should strive to delve deeper than surface level— really get to know your customers. Understand the motivating factors behind their purchase decisions and buying habits.

Enabling Capabilities

I hate to break it to you, but without the needed technology and tools, your digital strategy is just an idea. Your company’s digital capabilities are the fundamental building block for a successful digital transformation. Without the right support in place, nothing can flourish.

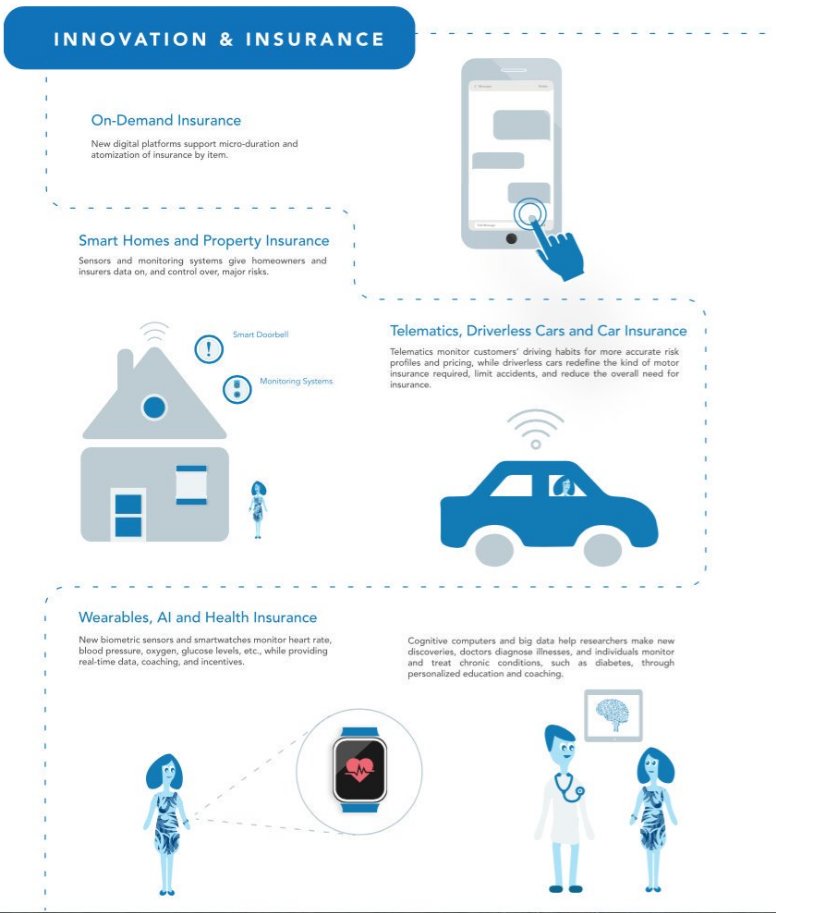

Technology & Tools

Digital transformations rely heavily on technology and specialized tools. They should be adaptable, dynamic, and centred around customer experience, operational processes and your business model. Predictably, mature companies utilize digital technologies and tools to achieve their strategic goals. Over 70% of mature companies encourage their employees to innovate with digital technologies, compared with only 28% of less mature companies. An extremely important facet of these technologies/tools includes digital analytics. As discussed in our previous post, digital analytics allow you to gauge your strategies success and shortcomings, so you can make improvements where necessary. They also give more precise data, allowing you to make better more informed decisions. Unsurprisingly, over 80% of digitally mature companies view digital technology as an opportunity.

Operational Model

Your operational model should fully support your digital transformation. Since your operating model facilitates the delivery of your business model, it must be digitally friendly. In other words, this model should align your business operations with your overall digital strategy. In fact, digitally mature companies transform their entire business processes, not just individual functions. Through this, you can increase control, efficiency, coordination and integration. This will have a significant positive impact on profit margins, and make it easier to break down roles, milestones and important KPI’s.

Digital Governance Framework

Your digital governance framework is the central component of a successful digital transformation. As you may know, this should align with your company’s structure, culture and strategic priorities. The policies and standards set forth outline what is acceptable and what is expected of each employee. This enables fast decision-making, increases accountability and can resolve internal conflict. Moreover, it shows the full picture, managing the chaos a digital shift can ensue, and making a smoother transition. To further mitigate risk and monetary costs, your digital governance framework should be adaptable and dynamic.

Digital Readiness Road Map

A full digital transformation can seem daunting and overwhelming, but creating a digital road map can help you organize your thoughts and simplify the process. Your road map helps plan the entire transition, by visualizing your end goal, and showing how you can get from point a, to point b. As explained by EY, it creates an organizational consensus on the focus, goals and requirements for digital readiness and analytics. Just like it sounds, without a digital road map, your strategy is directionless!

Digital Initiatives

Well thought out and executed digital readiness initiatives can give your organization a competitive advantage. When organizations mature, they focus on the following four initiatives: social, mobile, analytics and cloud. These initiatives should be integrated, and aligned with your overall strategy. Through this, you can increase customer engagement, tap into new profit pools and expand your overall reach.

Prioritization

During the shift, everything may seem important, so it is important for you to take a step back beforehand, and organize your thoughts. Review what your top priorities are, so you can use your resources in the most efficient way possible. The level of your digital readiness lies in your ability to set objectives and follow through. This enables fast decision-making, resolves conflicts (since no one is fighting over what to do next), and saves money. Change from chaos to organized chaos!

Benefits Model

During the planning process, you should know all of the associated costs and benefits of different initiatives. You should assess each individual initiatives need, value, impact and risk. In doing so, you can ensure you better plan your strategy, and earn the biggest ROI.

If you feel a bit overwhelmed after reading about what it entails to be digitally ready, don’t worry. Only 15% of companies at early stages of digital maturity have a digital strategy. Our goal is not to transform your business overnight, but to give you the information you need to ensure a successful digital transformation long-term.