Examining the powerful forces driving massive change within the insurance marketplace

This is an excerpt from our most recent guide “What is Insurtech? And Why The Insurance Industry Should Take Immediate Notice”

When compared to other sectors of “big business,” the insurance industry has—at least historically speaking—been left to operate uninterrupted, out of reach from the aggressive startup movement that has radically transformed and reshaped so many other industries.

This simply isn’t the case any longer.

Over the last three years, in particular, startup funding has increased dramatically. In fact, according to a recent PWC report released last year, 90 percent of insurers say that they fear they will lose business to startups as investments in InsurTech has increased five-fold.

To understand why the InsurTech marketplace has seen such explosive growth over the past few years, we need to understand the competitive forces that are most significantly impacting the insurance sector as a whole.

For the purposes of this post, let’s go over the five, key forces we need to understand:

- Incumbent carriers are feeling the heat from more nimble, tech-focused startups – Historically flat IT budgets and outdated legacy systems have made it more difficult for large, incumbent organizations to adapt to a new, modern marketplace. More importantly, InsurTech startups have shown the ability to quickly fill gaps in the marketplace, creating entirely new products and service offerings specifically tailored to tech-centric Millennials — the largest living generation of American consumers.

- The legislation simply cannot keep pace, leaving startups to quickly fill the gaps – The rise of the peer-to-peer (P2P) sharing economy (think Uber and Airbnb, among others) highlighted an important fact; legislation, as a general rule nowadays, simply cannot keep up with the pace of change. Lawmakers and startups could not be more polar opposites of each other—one group moves begrudgingly slow and the other lightning quick. This divergent movement creates gaps and loopholes (not to mention regulatory nightmares), allowing nimble startups to introduce never-before-seen products and services that often threaten the very existence of larger, more traditional insurers. While usually good for customers, it can spell doom for big business.

- Big data continues to confound traditional insurers, empower new entrants – Insurance is a data-driven business, and big data is BIG business. The rapid increase in available software, specifically cloud-based computing, connected devices and telematics, has made data more accessible than ever. Still, most traditional insurance companies, burdened by rigid, antiquated systems, have yet to capitalize. Instead, smaller, more agile, InsurTech startups have stepped in to fill the void. Big data remains one of the most difficult challenges for large, incumbent insurers.

- New entrants are joining forces to solve the cyber security puzzle – Cyber crime costs are projected to reach $2 trillion by 2019, which makes cyber security a puzzle that’s obviously worth solving. Yet, as the free flow of data (specifically, Cloud data) becomes more accessible, insurers—not unlike other big businesses—face mounting security challenges. To solve some of these challenges, there are new entrants like Cyence, a startup that provides a first-of-its-kind cyber risk analysis for insurers. According to Cyence, the economic cyber risk modelling platform “helps companies when they’re the target of cyber-attacks.” Many of these companies have joined forces with FinTech (yes, that would be “Financial Tech”) startups who are solving similar challenges. Update, Cyence has been acquired by Guidewire.

- Traditional insurers, in an effort to close the gap, continue to gobble up talent – Talent tends to follow funding. As a result, there has been an influx of skilled software talent. Traditional insurers, too, have joined the hunt for top-notch tech talent — albeit in a slightly different way. According to Gartner, the global insurance industry (North America, in particular) is investing heavily in insurance technology start-ups. In fact, Gartner reports that 80 percent of life, property and casualty insurers worldwide will “partner with or acquire InsurTechs to secure their competitive positions by the end of 2018.”

Needless to say, traditional insurance companies are at a crossroads. And judging by the number above, most have made their decision.

But, who are these InsurTech startups?

Let’s take a look.

InsurTech Startups: the most disruptive, well-funded startups currently reshaping the insurance marketplace

There is an ever-growing laundry list of startups currently taking aim the insurance sector and that doesn’t even count other FinTech startups who are attempting to do the same thing!

Some are taking aim at auto insurance, exclusively.

Not to be outdone, here are eight more hoping to disrupt the life insurance market.

You get the idea.

Yet, there are a handful of startups, in particular, that are making waves early in 2017:

- Lemonade: Lemonade offers fast and low-coverage homeowners and renters insurance “powered by technology.” It sells rental insurance policies for as low as $5 and home insurance for as little as $35. The company has raised more than $90 million, including $34 million Series B in late 2016.

- Metromile: Metromile offers pay-per-mile car insurance powered by a proprietary device, Metromile Pulse, a free wireless device that plugs into your car. Once the device is installed, it calculates your monthly mileage to determine your bill. The company claims its customers save an average of $500 annually. To date, Metromile has raised more than $200 million in funding!

- Trov: Trov calls itself “on-demand insurance for the things you love.” Essentially, Trov lets you purchase low-cost, accidental theft, damage, and loss policies on everyday items—with just a few text messages. That’s right. The entire experience can be handled safely and securely from a smartphone. The Australia-based company has raised more than $46 million to date and plans to launch in the U.S. later this year.

- Clover Health: Clover is a full-service insurance company that “implements metrics to figure out the best protocol for a patient who is at risk for health problems. It aggregates reports from a patient’s various medical services to generate a comprehensive profile of the person’s health” (source). Clover is currently available in New Jersey only, though it has plans to expand elsewhere in the near future. And get this—Clover has raised nearly $300 million in funding!

Obviously, this is but a small sampling of the types of startups who are benefitting from an influx As you may already know, of investment dollars (and clearly for good reason). If you want to learn more about insurTech, you can download the full guide for free here: “What is InsurTech? And Why The Insurance Industry Should Take Immediate Notice”.

Sources: http://insights.instech.london/post/102d2yk/24-companies-shaping-instech-globally

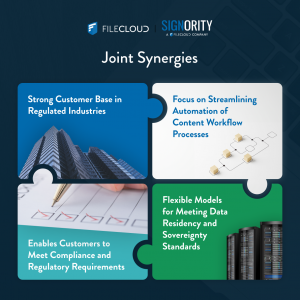

Ready to take your business paperless? Sign up to get a 14-day free trial on a Signority eSignature Plan!