As the use of technology is becoming more prevalent in everyday business, insurance included, there are aspects that are prone to high levels of risk, and require ramping up on security. While it may look like a mundane issue at first, it can have severe consequences for your company. As more insurance companies, in particular, are migrating towards digital channels in order to create tighter relationships with their customers, they also are trusted with sensitive personal information for each client such as Social Security Numbers, credit card data, and so much more. In case — but, hopefully not — you are a victim of a cyber attack, what does this mean for you? Let’s take a look at some of the insurance risks to consider when looking at cyber attacks!

Lost Sales

Cyber attacks are not always orchestrated by large-scale, highly qualified hackers, but even small DOS (denial of service) attacks can pose a great risk and affect your company severely if they catch you unprepared. Seeing as insurance companies collect data from their customers that range from personal information such as addresses, passport numbers, Social Security Numbers (SSN) or EIN, to financial info including, but not limited to credit card numbers, PINs, anything really, it is understandable for your customers to be wary, in case you have had to deal with a cyber attack previously. Studies say that 60% of SMEs who have been a victim of such attacks go out of business within three months.

Another type of cyber attacks that can cost your company quite a lot is called ‘Social cyber attack’. The most clear-cut example was the group of protesters who collectively attacked PayPal for not allowing payments to WikiLeaks. While it didn’t go down entirely, the lost sales were tremendous.

Protection Costs

According to a recent article published in Forbes magazine, cyber crime costs are projected to reach $2 Trillion by 2019. Which means that businesses need to be extra-vigilant when it comes to protecting their data.

Doing business online comes with a great number of rewards, but also with a risk or two. If you do insurance online, then you have to be aware of the cyber attacks at all times. For this, you have to prepare and protect yourself before hackers even try to get to you, and this preparation has to be thorough.

To avoid the risk of getting hacked and losing critical data, you have to hire qualified and capable people who can take care of the cyber-security section of your digital business. If you want your help to be highly professional, then you will have to spend a good amount of money for supporting it, both in terms of hiring competent IT staff and for other overheads required for smooth operations.

Changing your business model

Financial costs are not the only thing insurance companies have to worry about when dealing with cyber-crime. They have to remodel the way information is collected, stored and handled, so as to ensure that sensitive information is safe and non-vulnerable to these kinds of attacks. Many businesses have elected to altogether stop storing their customers’ financial and personal information, some others have shut down their online presence, at least online stores, if not all. This is all done when they cannot protect themselves properly, as the implications such attack can have on them, can be fatal.

Lately, customers also are being more proactive in educating themselves on online security and request to be informed on how their insurance company of choice handles security issues. You may have noticed that clients are more likely to choose businesses that are upfront and sincere about their methods — we noticed this soon after we launched our post on transparent pricing!

Making these changes to prepare and protect you and your company from these cyber risk are integral and can be daunting, but minor changes in the way you conduct business, the infrastructure, and various technological advancements can all be used to help mitigate much of the risks and improve your company.

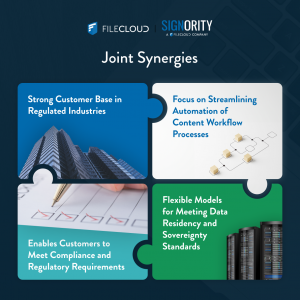

Begin looking into cheap and secure methods to improve small processes of your work before ramping up to bigger, more complex security issues. Try looking into things like eSignature solutions, that can provide extra layers of security to already existing workflows and processes! Learn more by checking out our website or feel free to contact us directly with more questions!

Looking to take your business paperless? Sign-up now and get a 14-day free trial to a Signority eSignature Plan.