Back in January, waspbarcode released fresh data from their small business survey indicating that not only do small business have a marketing budget, they also intend to increase it in 2017. Investing in marketing is great for business growth, especially if the investment allows businesses to reach new customers. The report did mention those small businesses are considering investing some of that budget in online marketing, but is that the right thing for your growing organization?

When I talk to owners of small and medium businesses, they quickly mention Facebook and Google Adwords as the place to start, and that is understandable, these platforms have great targeting ability and the largest audience reach. Google also has the added advantage of search intent. If I am searching for Car insurance, I am more likely to be looking to purchase a policy soon. But are there any things to look out for? Let’s look at the insurance industry.

It turns out that keywords related to insurance are the most expensive ones to bid on, $54.91 USD is the cost of a click on an insurance related ad according to data released by wordstream. Using this data 100 clicks would cost a company $5,491, and if your website is typical it would convert at an 4% rate, that means of the 100 customers that clicked 4 would have provided their information and become a lead, a cost of $1,372.25 per lead. There are ways to optimize that experience, no doubt one can get to a 10% conversion rate by using well-designed web pages, placing good offers on the website, etc…, if we use a 10% rate, the cost per lead is $549.1

That is the range for Cost Per Lead online, approximately $549 – $1,372.25 for an insurance broker. If your brokerage is looking to acquire 100 customers from the web channel, what should your budget be? That number highly depends on how well your brokers/agents close leads, if we assume that they are able to close 54% of all leads, then the cost per customer would be 2*Cost per lead, or $1,098 on the low end or $2,744 on the high end.

The question is, can this be optimized? Remember that customers searching for car insurance probably clicked a few ads and are getting quotes from various parties, converting these customers fast is key to success, here are some tips to convert potential customers.

Optimizing Your Online Ad Spending

-

Create a Well-Designed Web Page and Clear Value Proposition

Make sure you have a well-designed web page and a compelling offer to increase your website conversion page. In a previous article on usability, we gave some tips on how to optimize your website for a better customer experience

What is important is to create a compelling and clear value proposition: A value proposition is a business declaration that describes why your potential customer should use your product or service. Usually, a great value proposition should address what your company does, how are you are different or unique and who your company serves.

A/B test website content: Split testing, most popularly known as A/B testing, is a method of determining the more successful content piece (that could be a web page, copy or even buttons) by putting two variations of content against each other and basing it on a common goal set by you.

The goal could be, the number of conversions, sign-ups, increase in downloads etc.

-

Responding and Interacting to Leads

Responds to leads fast: the 5-minute rule is in full effect here, data released by The Lead Response Management study show that the odds of contacting a lead if called in 5 minutes versus 30 minutes drop 100 times. The odds of qualifying a lead if called in 5 minutes versus 30 minutes drop 21 times. So stay on top of those leads.

Address objections: Objections are a part of the buying cycle and are inevitable. The critical part about an objection is to understand that it might be due to your potential customer’s lack of knowledge regarding your product or inability to understand your solution thoroughly.

Listening to your customer and addressing these objections in a concise manner is primary for your business’ success. In terms of your site, spend the time to address typical questions that you expect or have been asked frequently through an FAQ page or even landing page copy and imagery.

-

Increasing Trust

It’s natural tendency to make a purchase from a person or company that you trust, so why would this be different for your potential customer? Ensuring you give your potential customers a reason to trust you and your product can be critical in the conversion process. Few ways you can do that is:

- Being transparent about the services or product features you offer.

- Always honor any promises you make to your customers, whether online or offline.

- Display your product or service’s price on your website.

- Show social proof by creating a section for mentions or quotes about your product or service from happy customers.

- And finally, be consistent with your brand and product throughout your website, collateral and communication.

-

Sealing the Deal – Online

Remove the possibility of leakage: customers do not want to print, sign, scan, fax, it’s inconvenient and if I am shopping my quote around and your competitor sent me a document ready for my digital signature, you would have lost me as a potential customer. Stats show that 46% of customers drop off after a broker sends them a paper based quote. In terms of Google online ad spending, that equals $43,920, meaning that if a digital signature solution saves one customer dropping off, the $50 investment is well worth it!

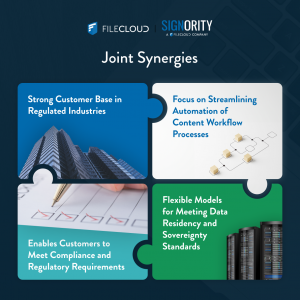

Looking to seal the deal? Why not try Signority’s Digital Signature solution for free. Click here